- Get link

- X

- Other Apps

Your boss reimburses you at a rate of 35p per mile. You can record business mileage in one of two ways.

Federal Mileage Rates For 2020 Nonprofit Update

Federal Mileage Rates For 2020 Nonprofit Update

What is classed as business mileage.

Business mileage rate. In this case you can claim tax back on the difference which is 10p per mile. If you travel 17000 business miles in your car the mileage deduction for the year would be 6250 10000 miles x 45p 7000 miles x 25p. So Max can claim 6000 30000 40000 075.

8000 x 075 6000. To figure out your deduction multiply your business miles by the applicable standard mileage rate. 52 per kilometre driven after that.

To deduct business mileage using the standard mileage rate multiply the actual business miles driven by the standard mileage rate published by the Internal Revenue Service IRS for the tax year the driving occurred. Youve racked up 10000 in business mileage on your personal car. 58 per kilometre for the first 5000 kilometres driven.

Up until 2017 anyone could write off mileage expenses they incurred for business purposes as itemized deductions on their tax returns. To use the standard deduction you must use it in the first year then you can choose either method in later years. There are some restrictions on the use of these two methods.

The IRS sets the standard mileage rate each year. Calculating your mileage deduction. With the standard mileage rate you take a mileage deduction for a specified number of cents for every business mile you drive.

Business mileage is an important but often overlooked expense for sole traders contractors and directors employed by their limited companies. 14 Zeilen Standard Mileage Rates. 4 Zeilen 20p.

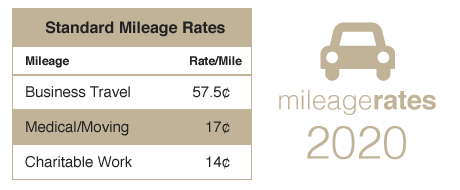

3 Zeilen First 10000 business miles in the tax year Each business mile over 10000 in the tax year. For the 2020 tax year the rate was 0575 per mile. For tax year 2021 the business use rate is 56 cents per mile.

The second method for the self-employed is a fixed simplified expenses rate for each mile set by HMRC. You must only claim for journeys that are wholly and exclusively for business purposes your. 1 2019 the standard mileage rates for the use of a car also vans pickups or panel trucks will be.

55 per kilometre for the first 5000 kilometres driven. The automobile allowance rates for 2018 are. Well also show you how to calculate your mileage deduction.

The automobile allowance rates for 2019 are. If the drive is for business purposes you can claim tax back from HMRC. For the 2020 tax year the standard mileage rate is 575 cents per mile.

58 cents per mile driven for business use up 35 cents from the rate for 2018 20 cents per mile driven for medical or moving purposes up 2 cents from the rate for 2018 and 14. This means you can deduct 1000 from your taxes 10000 multiplied by 10p. For the 2020 tax year the standard mileage rate for business use is set at 575 cents per mile.

In the Northwest Territories Yukon and Nunavut there is an additional 4 per kilometre allowed for travel. Business mileage covers the miles you travel for business purposes such as travelling to a client. The mileage rate is meant to simplify the record-keeping process ease the administrative burden and alleviate costs for both businesses and the tax authority.

According to the current AMAP rates you can claim 45p per mile on the first 10000 business miles and 25p per mile on anything over this limit. 1 Understanding the Standard. This is exactly the same approach to calculating the business mileage as.

You used up 15000 miles on personal journeys while the remaining 15000 were business miles. Multiply business miles driven by the IRS rate To find out your business tax deduction amount multiply your business miles driven by the IRS mileage deduction rate. Beginning on Jan.

The following table summarizes the optional standard mileage. Example During 2017 18 you racked up 30000 miles on your private car. Using actual expenses or using the standard deduction rate.

Your employee travels 12000 business miles in their car - the approved amount. Who qualifies for business mileage. You just need to multiply the miles you travelled by the specific mileage rate for your vehicle.

For the standard mileage rate multiply the total business miles by the standard mileage for the year. This makes calculating business mileage fairly simple. As a result the current AMAP rates are 45p per mile for the first 10000 miles and 25p per mile thereafter.

The 2021 standard mileage rate is 56 cents per business mile driven. With this in mind heres a definitive look at the UKs business mileage-allowance rates for 2020-2021. The mileage rate for the 2021 tax year is 056 per mile driven.

The Deductible Mileage Rate For Business Driving Is Increasing For 2019

The Deductible Mileage Rate For Business Driving Is Increasing For 2019

The Deductible Mileage Rate For Business Driving Decreases For 2020

The Deductible Mileage Rate For Business Driving Decreases For 2020

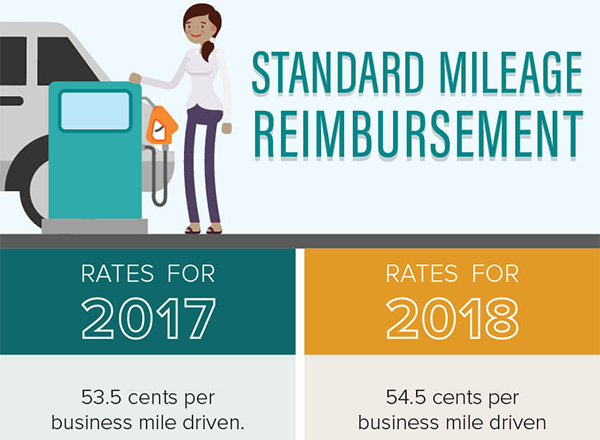

Standard Mileage Rate For 2018 Increases To 0 545 Henry Ford College

Standard Mileage Rate For 2018 Increases To 0 545 Henry Ford College

2020 Irs Standard Mileage Rate The Thriving Small Business

2020 Irs Standard Mileage Rate The Thriving Small Business

2020 Irs Business Mileage Rate Of 57 5 Cents Informed By Motus Cost Data And Analysis

2020 Irs Business Mileage Rate Of 57 5 Cents Informed By Motus Cost Data And Analysis

New 2021 Irs Standard Mileage Rates

New 2021 Irs Standard Mileage Rates

Company Mileage Reimbursement How To Reimburse Employees For Mileage

Company Mileage Reimbursement How To Reimburse Employees For Mileage

2020 Mileage Rates For Business Medical And Moving Announced Wilkinguttenplan

2020 Mileage Rates For Business Medical And Moving Announced Wilkinguttenplan

Irs Announces 2019 Mileage Rates The Amboy Guardian

Irs Raises Mileage Rates For 2019 Accounting Today

Irs Raises Mileage Rates For 2019 Accounting Today

Standard Mileage Rates For 2020 Dalby Wendland Co P C

Standard Mileage Rates For 2020 Dalby Wendland Co P C

2021 Irs Business Mileage Rate Of 56 Cents Calculated Using Motus Data

2021 Irs Business Mileage Rate Of 56 Cents Calculated Using Motus Data

Business Math Calculating Mileage When Using A Personal Vehicle

Business Math Calculating Mileage When Using A Personal Vehicle

Comments

Post a Comment