- Get link

- X

- Other Apps

To make it easier go over to Defipulse where you could input the asset and quantity youd like to lock up and generate the estimated income youll get. Daily distribution of the tokens is split between suppliers and borrowers in 5050 ratio.

Compound Download Compound Vector Logo Svg

So it costs a small amount of ETH to power the.

How to use compound crypto. To do this first load an Ethereum account with any of the cryptocurrencies supported by Compound. The interest rates paid and received by borrowers and lenders are determined by the supply and demand of each crypto asset. Compound Finance is an easy to use well tested DeFi protocol that lets you earn interest on your crypto take cryptocurrency loans and earn the COMP token.

Youll include the compounding interest rate of the platform youre. The formula for compound interest is as follows. Then on the Dashboard choose which cryptocurrency you wish to supply to the platform by clicking on it.

Though the Dapp browser in the Coinbase Wallet you can access Compound. Total Amount Principal x 1 Annual Interest Rate Number of Times Interest Compounds in the Year Number of Times Interest Compounds in the Year x Total Number of Years The amount earned on interest went up slightly on the second day as you had a higher starting balance. Then tap on Dai and then tap to enable the asset.

Users lock their cryptocurrency into large farming pools. Yield farming is similar to staking crypto in many ways. The amount of tokens a user can borrow depends upon the.

Tap Earn interest on your crypto and read through the next two screens in the app. Compound tokens are distributed to users that interact with the markets regardless of whether they borrow lend withdraw or repay an asset in proportion to the borrowing demand in the market. Loans can be paid back and locked assets can be withdrawn at any time.

Earn interest on your Dai tokens using Compou. Tap USD coin to continue. Compound allows many different crypto assets to be supplied in its system.

Earn a protected fixed return or a volatile high yield with risk tranching. In this tutorial I take you through Compound Finance the number 1 DeFi Platform. Compound focuses on allowing borrowers to take out loans and lenders to provide loans by locking their crypto assets into the protocol.

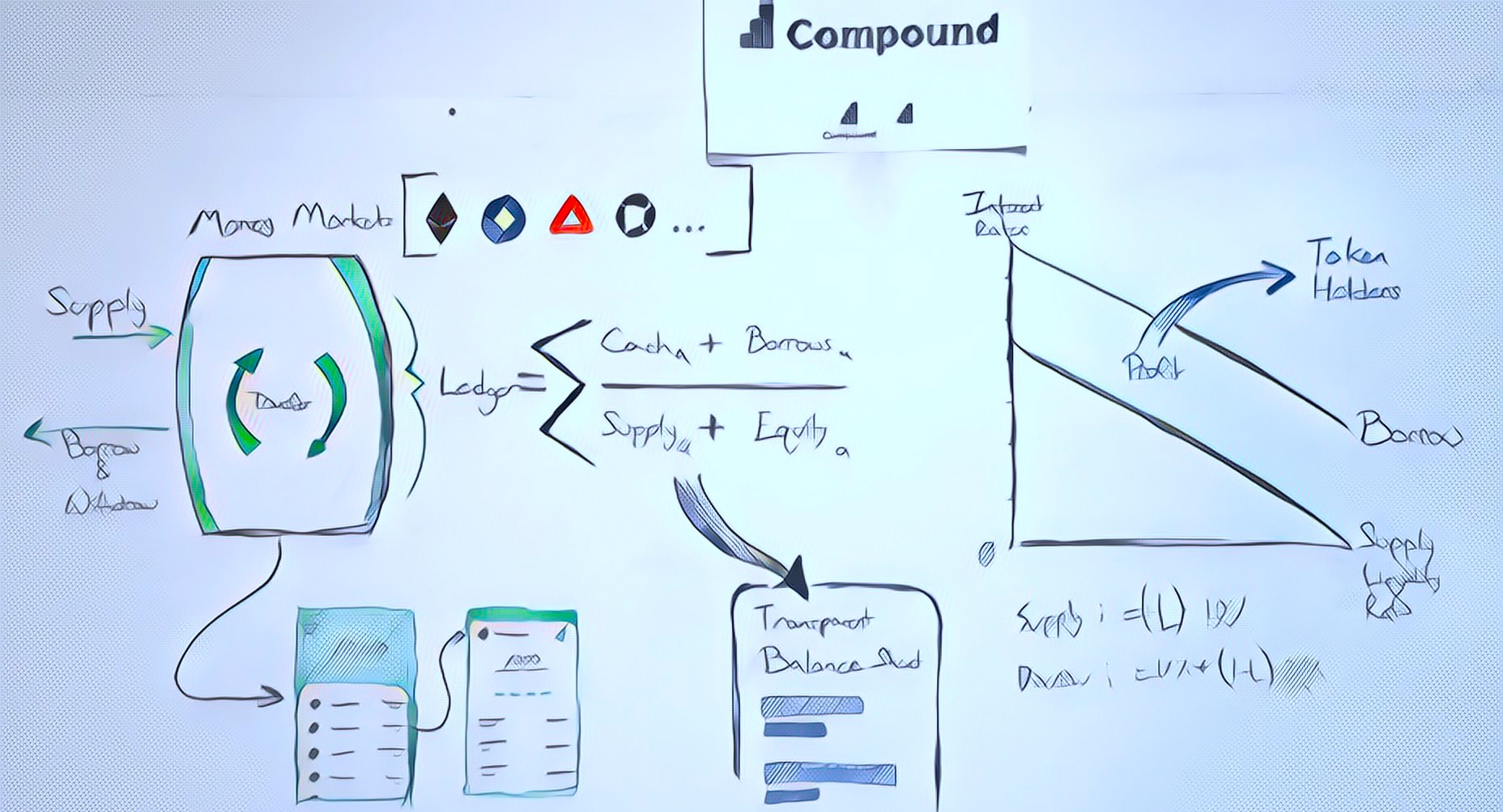

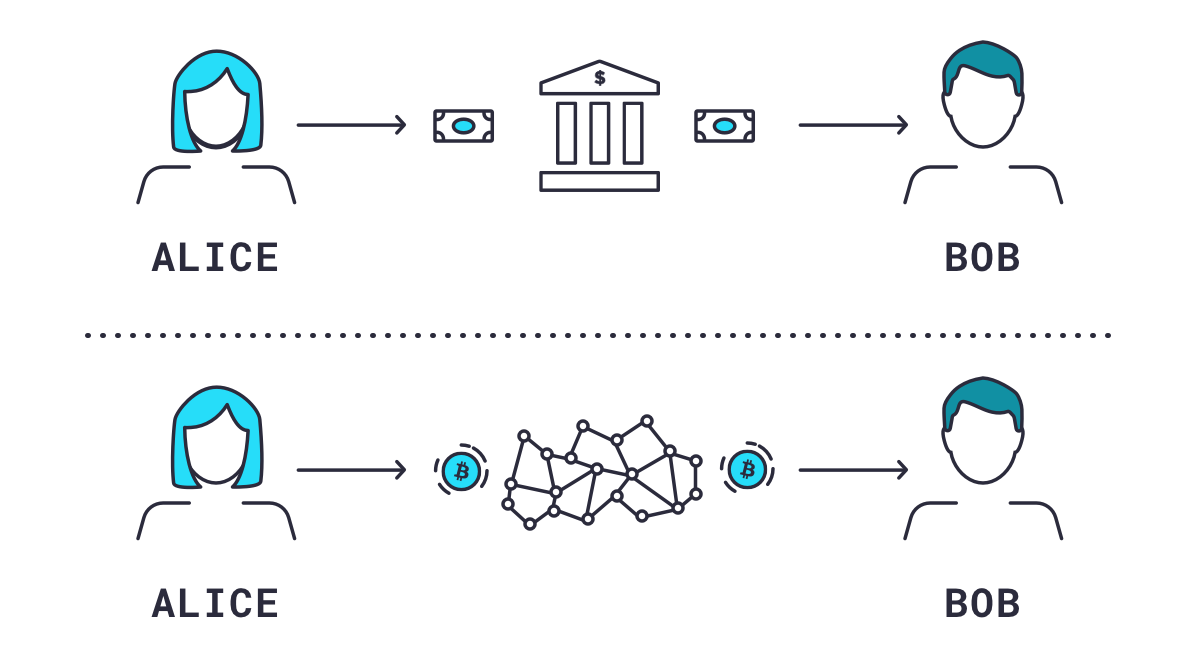

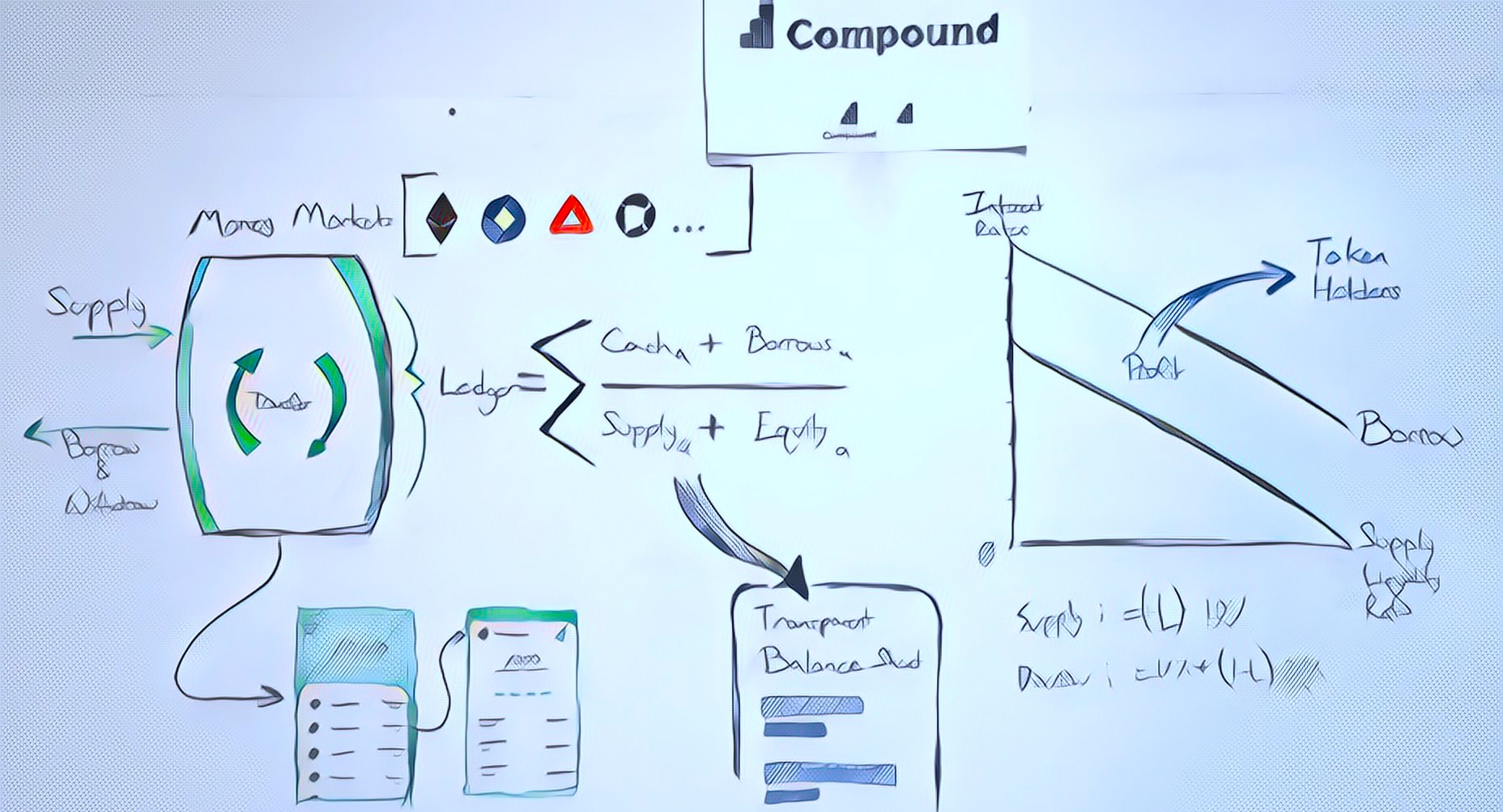

Compound Finance is an Ethereum-based open-source decentralized protocol that allows the users to lend and borrow cryptocurrencies by locking up their assets in smart contracts. A pop-up will appear displaying the Borrow APY amount of tokenyear youll pay. Users can directly lend their assets to the Compound Finance.

Compound Finance is an Ethereum-based open-source decentralized protocol that allows the users to lend and borrow cryptocurrencies by locking up their assets in smart contracts. You need to insert the principal amount of BTC or another crypto that youre going to deposit and specify whether youll make any additional deposits during the holding term or not. You will find more information about the Compounds technical features in its whitepaper.

Select Compound from the. Compound is primarily used to earn interest money by storing crypto assets on the platform. This Compound Finance tutorial teaches you how to easily begin earning interest on your Dai crypto stablecoins.

Choose which one youd like to lend. So right now a user will earn COMP faster if they interact with the DAI market rather than say 0x because the demand to borrow DAI is higher. It will cost you a small amount of ETH to enable the asset.

First click on the asset that youd like to Borrow. I show you how to earn interest on your Crypto and also how to borrow again. On Compounds website you can earn interest when you deposit Compound refers to this as supply cryptocurrencies onto their platform.

Compound is currently the largest DeFi lending protocol available on the market today running on the Ethereum blockchain. Just type the addresss compoundfinance into the address bar. You could even compare interest rates with other lending platforms.

You receive rewards based on the amount of crypto you lock and for how long you participate in the pool. Compound was the first platform to introduce yield farming to the market in mid-summer 2020. Fully-featured crypto wallet mobile app integrating Compound.

Secure Manage and Exchange on desktop mobile and hardware wallets. Remember that Compound is a Decentralised App which is running on the Ethereum Blockchain. To make things easier for you weve created a crypto compound interest calculator that helps you calculate the total amount of interest within seconds.

Users can directly lend their assets to the Compound Finance liquidity pool from which a borrower can borrow by locking up their assets as collateral. A keyless crypto wallet built mobile-first and supports Compound. It allows users to lend and borrow various ERC-20 tokens and gives them the opportunity to earn some pretty staggering rewards.

Interest rates are generated with every block mined.

Compound Comp Logo Svg And Png Files Download

What Is Compound Finance A Detailed Beginner S Guide Mycryptopedia

What Is Compound Finance A Detailed Beginner S Guide Mycryptopedia

The Compound Crypto Protocol S Defi Lending Token Gemini

The Compound Crypto Protocol S Defi Lending Token Gemini

How To Use Compound Finance Bitcoin Crypto Guide Altcoin Buzz

How To Use Compound Finance Bitcoin Crypto Guide Altcoin Buzz

What Is Compound Finance Shrimpy Academy

What Is Compound Finance Shrimpy Academy

What Is Compound Finance A Detailed Defi Guide

What Is Compound Finance A Detailed Defi Guide

Coinbase S First Investment Compound Earns You Interest On Crypto Techcrunch

Coinbase S First Investment Compound Earns You Interest On Crypto Techcrunch

Compound Finance Defi Tutorial How To Earn Interest On Your Crypto Comp Tokens Youtube

Compound Finance Defi Tutorial How To Earn Interest On Your Crypto Comp Tokens Youtube

How To Earn Interest And Borrow Ethereum Assets By Calvin Liu Compound Medium

How To Earn Interest And Borrow Ethereum Assets By Calvin Liu Compound Medium

Compound Review How To Earn Passive Income With Compound Asia Crypto Today

Compound Review How To Earn Passive Income With Compound Asia Crypto Today

Coinbase S First Investment Compound Earns You Interest On Crypto Techcrunch

Coinbase S First Investment Compound Earns You Interest On Crypto Techcrunch

What Is Compound Finance Comp A Guide To Hacks And Tips On The Latest Defi Platform

What Is Compound Finance Comp A Guide To Hacks And Tips On The Latest Defi Platform

Comments

Post a Comment