- Get link

- X

- Other Apps

It offers investment options from Columbia and Vanguard and a 426000 contribution limit. Vanguard 529 College Savings Plan Nevada This plan offers a large number of Vanguard index funds at some of the 529.

E Trade Core Portfolios Review Smartasset Com

E Trade Core Portfolios Review Smartasset Com

Many states have chosen to adopt the same policy and also allow tax-free withdrawals for qualified expenses.

/Etrade-core-portfolios-vs-TD-Ameritrade-Essential-Portfolios1-1c335a1e84ea4fd0b274f5762677905f.png)

Etrade 529 college. IMPORTANT information for Windows XP Users. But like most things you can make it as simple. 63 Zeilen Schwab 529 College Savings Plan.

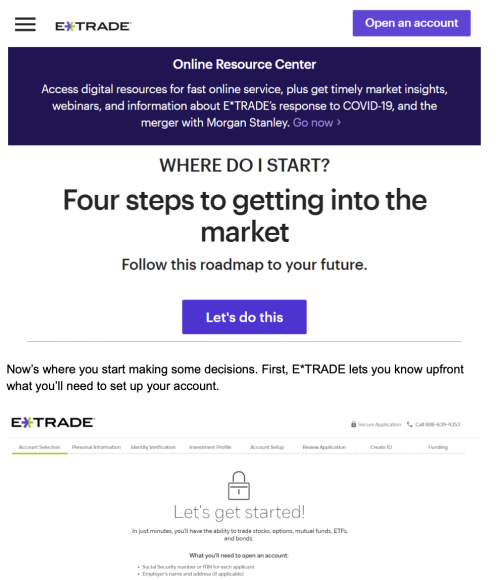

You can change the investment approach later. The College Board 2015-2016 You can invest in the mutual funds available through ETRADEs no-load no-transaction-fee program without paying loads transaction fees or commissions. Select a College Savings Plan.

This plan is one of the best ways to save because unlike most other savings plans education-related withdrawals are free from federal income tax. However at this time 529 plans only offer age-based portfolios designed to save for college. If you experience any issues when attempting to enroll with a Joint Account please contact us 800-387-2331 800-ETRADE-1 and we will be able to assist you with your enrollment.

Qualified family includes the beneficiarys siblings parents children first cousins nieces and nephews among others It really is as simple as it sounds. Use the money in your 529 for a wide range of educational expenses including college expenses K12 tuition certain apprenticeship costs and even student loan repayments. Additional information on Windows XP can be found here.

To discourage short-term trading ETRADE will charge an Early Redemption Fee of 4999 on redemptions or exchanges of certain no-load no-transaction-fee funds that are held for less than 90 days. You just change the name of the accounts beneficiary. Residents of South Carolina may enjoy a state tax deduction for contributions to the plan.

Some 529 plans have just one age-based portfolio while others have aggressive moderate and conservative age-based portfolios. The Future Scholar 529 College Savings Plan is only available to residents of South Carolina. Control Unlike a custodial account with a 529 plan the account owner maintains ownership of the.

This is the most difficult part for many savers. 529 college savings plans are the most common type. Download an application and then print it out.

Choose from core or socially aware investment options. This annual fee will be charged based on the average daily balance for the account during each quarter. Since January 1 2018 529 plans can also be used to pay for up to 10000 per year for tuition expenses at private public and religious elementary and secondary schools.

Complete and sign the application. If you start saving for college soon after the child is born an age-based portfolio is a good starting choice. These portfolios usually differ according to the initial percentage stocks eg 100 equities 90 equities or.

Age-Based Investment Option - these options are designed to reduce your portfolios exposure to loss of principal as the beneficiary nears college age. There are over 100 savings and prepaid 529 plans available. Five Best 529 College Savings Plans.

Parents interested in using a 529 plan to pay for K-12 tuition may want to consider a portfolio that is heavily allocated to fixed income since they have a shorter time horizon than someone who is saving for college. Investments grow tax-free and can be withdrawn tax-free for educational expenses such as tuition room and board and required. The base advisory fee for E-Trade Core Portfolios is 030 of your total account balance.

With individual 529 plans you can change beneficiaries without negative income tax consequences if say the original beneficiary decides not to attend college as long as the new beneficiary is a member of the original beneficiarys family. Please upgrade your computer to a supported version of Windows to continue to access your accounts. That total will be deducted from the accounts balance at the beginning of each new quarter.

TD Ameritrade 529 College Savings Plan offers three different investment options. A 529 College Savings Plan is one that allows parents to put aside money for the future higher education expenses of their children. After December 4 2016 you will no longer be able to access your 529 plan accounts using Windows XP.

Send the application with a check made payable to ETRADE Securities or ETRADE Bank depending on the type of account youre opening to the appropriate address.

Etrade Review Competitive Pricing And Robust Service

Etrade Review Competitive Pricing And Robust Service

Td Ameritrade 529 College Savings Plan 2021

Td Ameritrade 529 College Savings Plan 2021

E Trade 2021 Review Online Stock Broker For Active Traders

E Trade 2021 Review Online Stock Broker For Active Traders

Fidelity Vs Etrade Which Is The Perfect Online Brokerage Platform For You Biltwealth

Fidelity Vs Etrade Which Is The Perfect Online Brokerage Platform For You Biltwealth

/Etrade-core-portfolios-vs-TD-Ameritrade-Essential-Portfolios1-1c335a1e84ea4fd0b274f5762677905f.png) E Trade Core Portfolios Vs Td Ameritrade Essential Portfolios Which Is Best For You

E Trade Core Portfolios Vs Td Ameritrade Essential Portfolios Which Is Best For You

/wealthfront-vs-etrade-core-portfolios-3cf44d7f34e846d6993d425e0d9f3888.jpg) Wealthfront Vs E Trade Core Portfolios Which Is Right For You

Wealthfront Vs E Trade Core Portfolios Which Is Right For You

Congress Extends Critical Legislation Enabling Employers To Enhance Financial Wellness Programs Business Wire

Congress Extends Critical Legislation Enabling Employers To Enhance Financial Wellness Programs Business Wire

Etrade Review Competitive Pricing And Robust Service

Etrade Review Competitive Pricing And Robust Service

Etrade Review Competitive Pricing And Robust Service

Etrade Review Competitive Pricing And Robust Service

:max_bytes(150000):strip_icc()/etrade_core_portfolios_productcard-171c577c476c4b3dbe080a008f0cb033.png) Wealthfront Vs E Trade Core Portfolios Which Is Right For You

Wealthfront Vs E Trade Core Portfolios Which Is Right For You

E Trade Review Grow Your Wealth Your Way

E Trade Review Grow Your Wealth Your Way

E Trade Is Offering A Sweet 100 Cash Bonus On New Accounts The Simple Dollar

E Trade Is Offering A Sweet 100 Cash Bonus On New Accounts The Simple Dollar

Find The Balance Between Competing Financial Priorities

Find The Balance Between Competing Financial Priorities

Comments

Post a Comment