- Get link

- X

- Other Apps

Despite the clear benefits a direct public offering has several drawbacks. When a corporation goes public it issues an initial public offering in which it sells shares of the company stock on the open market and raises capital.

![]() Public Offering Of Common Stock Daytrading

Public Offering Of Common Stock Daytrading

The offered securities are then issued allocated allotted to the new owners.

Public offering of common stock good or bad. Similar to an initial public offering a direct public offering can divert the attention of employees for many months. When a company makes a secondary offering its issuing more stock for. The information contained in the shelf offering statement varies depending on whether the offering.

Shelf offerings can be delayed offerings or continuous offerings. Thats one of the hidden hazards of buying a small cap or growth stock thats still capital hungry. Most public offerings are in the primary market that is the issuing company itself is the offerer of securities to the public.

When a company goes public its usually cause for celebration for investors. Too many investors think a secondary stock offering from a growth stock is a bad thing. Stockholders in turn are given a percentage of ownership of the company.

A company that is a short-staffed might find itself in a state of chaos when it is most important to make a good. When a company makes a secondary offering its issuing. Unlike debts an issuer of common stocks is not obligated to pay interest to investors only discretionary payments on dividends in the event that the company.

Regardless of the reasons for the IPO offering stock means an injection of capital into the business. There are far too many examples of companies that issue shares of stock just to keep the lights on and to meet payroll. An offering is an underwritten a firm commitment offering and will consider the nature of the marketing process in determining whether an offering is a public offering If a registered direct offering is not considered a public offering by a securities exchange that.

In a continuous offering the company is agreeing to make shares available for sale immediately though it might not actually sell any immediately and that is the companys choice. In some cases they are. But when companies return to the capital markets to do secondary offerings of stock the shares often get a.

Underwritten Public Offering means any offering of Common Stock to the public including Requested Public Offerings either on behalf of the Company or any of its securityholders pursuant to an effective registration statement under the Securities Act and in which such Common Stock is sold to an underwriter or underwriters on a firm commitment basis for reoffering to the public pursuant to an underwriting. A company issuing common stocks in the financial markets use them as an alternative to debts as it is a less expensive route. Once a business has offered common stock and warrants through an IPO it must begin pursuing an operational strategy.

If it is an offering of shares this means that the companys outstanding capital grows. On the other hand if the public. According to conventional wisdom a secondary offering is bad for existing shareholders.

There are non-dilutive secondary offerings but theyre obviously not dilutive. How to Find the Markets Best Early-Stage Growth Stocks. As for secondary offering additional stock issuance after the company has already gone public it greatly depends on the companys standing in the shareholders and publics eyes.

Secondary offerings almost always dilute existing shareholders. According to conventional wisdom a secondary offering is bad for existing shareholders. IPO or initial public offering is usually seen as great news for the existing investors and intriguing to the potential public investors.

In a delayed offering the company does not intend to make any shares available for sale until later in the three-year window. If the company is hot and fast growing secondary offering normally wouldnt be seen as negative and subscription would high. The process is not simple and involves a great deal of information gathering to prepare a registration statement to file with the SEC.

This is money that leaders can choose to spend on acquiring other businesses marketing to increase its customer base expanding into new markets or developing new products. These stocks which are usually bad investments usually trend down or at best sideways before. LLC intends to offer the shares of Class A common stock to the public at a fixed price which may be changed at any time without notice.

Even after issuing common stock a business. Sometimes you will see your shares diluted which lowers the price of each individual share. Morgan Stanley Co.

Sometimes companies will use a secondary offering to sell more stock and raise additional funds.

The Long Run Performance Of Initial Public Offerings Ritter 1991 The Journal Of Finance Wiley Online Library

The Long Run Performance Of Initial Public Offerings Ritter 1991 The Journal Of Finance Wiley Online Library

Stock Public Offering Good Or Bad

Stock Public Offering Good Or Bad

/SHAREBUYBACKFINALJPEGII-e9213e5fe3a9435b9d0cc4d33d33a591.jpg) Why Would A Company Buy Back Its Own Shares

Why Would A Company Buy Back Its Own Shares

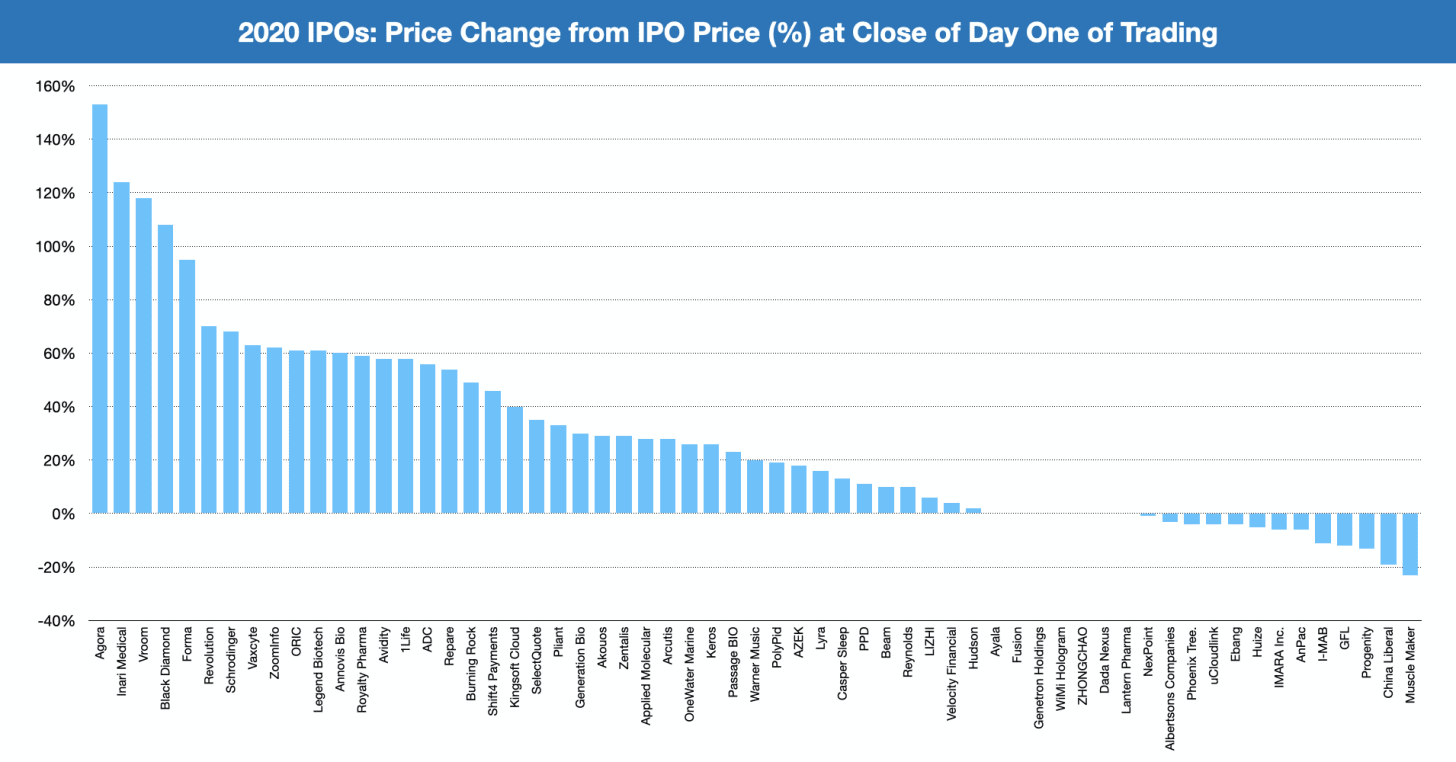

Why The Day One Ipo Pop Is Overhyped Marker

Why The Day One Ipo Pop Is Overhyped Marker

Chapter 5 The Stock Market Ppt Download

Chapter 5 The Stock Market Ppt Download

What Is An Ipo Why Do Companies Go Public Forbes Advisor

What Is An Ipo Why Do Companies Go Public Forbes Advisor

Pdf Ipo Underpricing And Short Run Performance An Empirical Analysis Of Its Impact To The Number Of Ipo Listings On The Zimbabwe Stock Exchange Zse

Pdf Ipo Underpricing And Short Run Performance An Empirical Analysis Of Its Impact To The Number Of Ipo Listings On The Zimbabwe Stock Exchange Zse

What Is A Stock Offering And Is It Good Or Bad

What Is A Stock Offering And Is It Good Or Bad

/WhatIsanIPO-ae91b1cf879c445d8b65650c649c3e54.jpg) What Is An Initial Public Offering Ipo

What Is An Initial Public Offering Ipo

Ipo Process Steps To Going Public Popular Alternatives

Ipo Process Steps To Going Public Popular Alternatives

Why The Day One Ipo Pop Is Overhyped Marker

Why The Day One Ipo Pop Is Overhyped Marker

/PieChart-a03169748eb343c681b8b56e38154dbf.jpg) Company Share Price And Secondary Offering

Company Share Price And Secondary Offering

Is A Public Offering On A Company Always Bad News For Investors Quora

Comments

Post a Comment