- Get link

- X

- Other Apps

With all else being equal a highly volatile fund has more risk than one with low volatility. While most of the lowest-volatility international offerings are world-stock funds meaning they own US.

Vix Etfs The Facts And Risks Charles Schwab

Often referred to as fear indicators these funds tend to move in the opposite direction of the broad market.

Volatility index fund. Wednesdays Volatility Spike Was a Gift for SP 500 Option Sellers Jan. 60 in stocks and 40 in bonds. 29 2021 at 936 am.

A fund with high. Sector shifts in SPLV arent surprising because the fund is designed to be sector-agnostic. Thus these funds are used primarily by traders looking to capitalize on sharp market downturns.

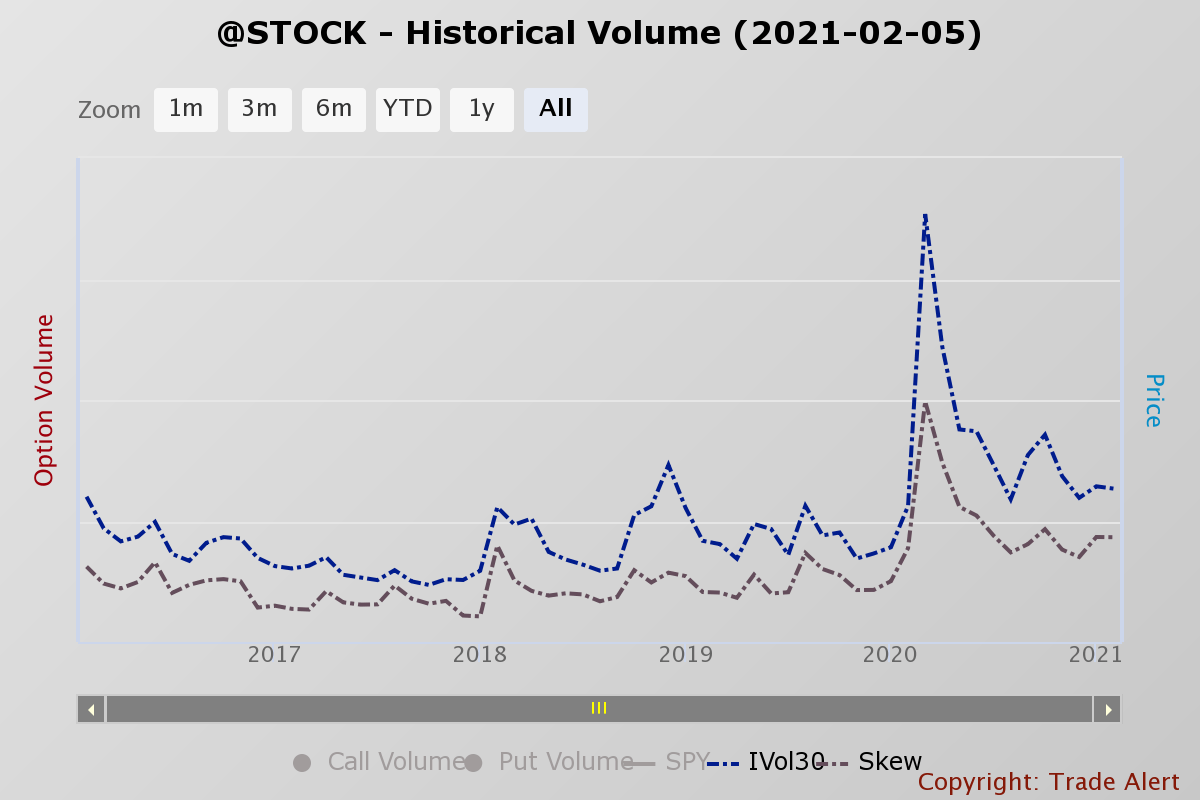

Volatility is the extent to which a funds net asset value typically fluctuates. Volatility ETFs offer exposure to volatility in one form or another. Volatility Funds and ETFs are mutual funds that bet on the volatility asset class or the various VIX indexes.

This is done by using various futures swaps and other derivatives for the various. Min vol ETFs do not ensure against losses. The fund keeps its mix steady.

The SP 500 Low Volatility Index is. SPLV tracks the SP 500 Low Volatility Index and is a good choice for conservative investors who are seeking low volatility and great performance says David Reyes chief financial architect at. And foreign stocks this venerable fund is one of the lowest-volatility offerings composed.

It bounced around some but without any. Minimum volatility ETFs commonly referred to as min vol ETFs attempt to reduce exposure to stock market volatility. Low Volatility Across the Board.

The VIX index portrays the price volatility embedded in the option prices of the SP 500 Index for the next 30 days. NAV 1-Day Return. Quote Fund Analysis Performance Risk Price Portfolio People Parent.

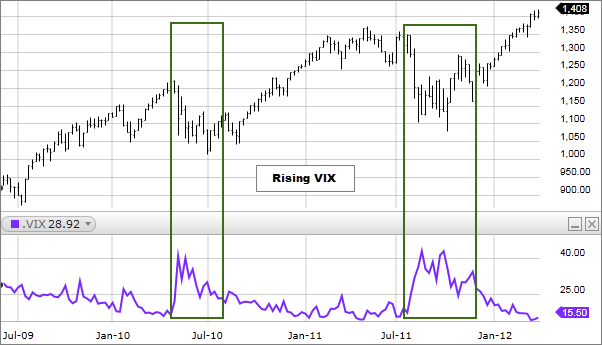

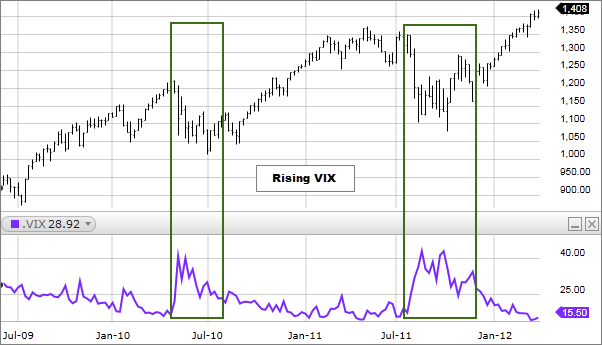

Exchange traded funds The Chicago Board Options Exchange Volatility Index VIX index attracts traders and investors because it often spikes way up when US equity markets plunge. The Cboe Volatility Index or VIX which measures the SP 500s volatility and is known as the fear index hit an all-time low of 91 in November 2017. Vanguard Balanced Index symbol VBINX has a consistent record of above-average returns with below-average volatility.

Normally investing at least 80 of assets in equity securities included in the Fidelity International Low Volatility Focus Index which reflects the performance of a broad range of equities across developed markets excluding the US Canada and South Korea that in the aggregate have lower volatility relative to the broader foreign developed equity markets. Investors need to understand that these funds track the futures on the VIX not. The fund tracks the SP 500 VIX Short-Term Futures Index which follows the movements of a combination of VIX futures and is designed to track changes in the expectation for VIX.

Quantitative rating as of Mar 31 2021. Known as the fear gauge the VIX index reflects the markets short-term outlook for stock price volatility as derived from options prices on the SP 500. These funds track indexes that aim to provide lower-risk alternatives relative to more risky investments.

What Is The Vix Volatility Index And How Do You Trade It

What Is The Vix Volatility Index And How Do You Trade It

:max_bytes(150000):strip_icc()/dotdash_v3_Moving_Average_Strategies_for_Forex_Trading_Oct_2020-01-db0c08b0ae3a42bb80e9bf892ed94906.jpg) Cboe Volatility Index Vix Definition What Is It

Cboe Volatility Index Vix Definition What Is It

:max_bytes(150000):strip_icc()/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-02-289fe05ed33d4ddebe4cbe9b6d098d6b.jpg) The Volatility Index Reading Market Sentiment

The Volatility Index Reading Market Sentiment

:max_bytes(150000):strip_icc()/dotdash_Final_CBOE_Volatility_Index_VIX_Definition_Aug_2020-02-c820dbe721f84e37be0347edb900ba5b.jpg) Cboe Volatility Index Vix Definition What Is It

Cboe Volatility Index Vix Definition What Is It

Investors Wager On Lower Volatility This Year After 2020 Turmoil Financial Times

Investors Wager On Lower Volatility This Year After 2020 Turmoil Financial Times

What Is Vix Cboe Market Volatility Index Fidelity

What Is Vix Cboe Market Volatility Index Fidelity

/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-01-ee4f3ae7447541368fd404e8bf9e987e.jpg) The Volatility Index Reading Market Sentiment

The Volatility Index Reading Market Sentiment

Searching No Results View More Result S Filter Results By Untick To Narrow Your Search Bonds Unit Trusts Etfs Stocks Managed Portfolios Insurance Articles Faq Clear All Diamond Gold Silver Clients Enjoy S 10 Flat Processing Fee Permanently For

Searching No Results View More Result S Filter Results By Untick To Narrow Your Search Bonds Unit Trusts Etfs Stocks Managed Portfolios Insurance Articles Faq Clear All Diamond Gold Silver Clients Enjoy S 10 Flat Processing Fee Permanently For

The Vix May Hold The Key To Where The Stock Market Goes Next Vix Seeking Alpha

The Vix May Hold The Key To Where The Stock Market Goes Next Vix Seeking Alpha

Small Cap U S Index Funds The Motley Fool

Small Cap U S Index Funds The Motley Fool

Volatility Strikes Back Imf Blog

Volatility Strikes Back Imf Blog

Investors Wager On Lower Volatility This Year After 2020 Turmoil Financial Times

Investors Wager On Lower Volatility This Year After 2020 Turmoil Financial Times

Comments

Post a Comment