- Get link

- X

- Other Apps

The deduction is limited to Rs 2 lakh for self-occupied house property subject to underlying conditions whereas there is no upper limit on the amount of interest that can be claimed as deduction for let-out. 1 Hour Tax Refund Loan.

Refund Advance Tax Loan Find Out If You Qualify

Refund Advance Tax Loan Find Out If You Qualify

Youll only be able to get one of these loans if youve submitted your taxes through a tax filing company like the ones listed above.

Pre income tax loans. The loan amount is deducted from tax refunds reducing the amount paid. Pre-tax income is your total income before you pay income taxes but after your deductions and is also known as gross income. We understand this and have responded by providing lenders who focus entirely on 1 hour tax refund loans.

1 50000 as income tax deduction under section 80C of Income tax act. We keep all data confidential and we only use it to process your income tax loan. In that case you may be.

A tax refund loan is a short-term loan that you can use to get the value of your federal income tax refund just a bit sooner. We want what we need now not later. Early Refund Advance Loans are offered prior to your filing your tax return and you are not required to provide all information necessary to file your tax return to apply but you must provide a most recent pay stub or equivalent form of evidence of income upon which Jackson Hewitt can make a preliminary estimate of your tax refund.

You must apply online so your application can be processed while you wait. Your pre-tax income is now 36000. For instance your pre-tax deductions would include your retirement investment accounts such as a Roth IRA 401k 403 b and health savings accounts.

Pre-Tax Operating Income Gross Revenue - Operating Expenses Depreciation. You can claim up to Rs. Your credit is not even considered for these types of loans.

The amount of the advance - 200 to 500 - will be deducted from tax refunds and reduce the amount that is paid directly to the taxpayer. Pre construction period as per Income Tax means. An employee loan which for taxable benefit purposes includes any form of credit is given to an employee with the expectation that the amount is to be repaid in full to the employer often via a pre-agreed deduction from the employees net salary.

A tax refund anticipation loan can be approved in a manner of minutes and the money is usually accessible within a day or two. Lets say your salary is 40000 and you invest 10 which equals 4000. An exception is when the vested balance is less than 10000.

Tapati Ghose Partner Deloitte India says that as per the provisions of the Income Tax Act interest on housing loan can be claimed as a deduction while computing the taxable income. A one hour tax refund loan is fast. When the refund arrives the lender will take the money lent to you out of that refund before the rest of the money is sent over to you.

Income Tax benefits Prepayment of home loan in addition to your EMI will also cover under section 80C for your income tax deductions as this amount is a repayment of your principal amount. P eriod starts from disbursement of loan to the end of Financial year immediate proceeding to the year in which house is completedIn above case pre -construction period means period starts from Jan 2014 to 31032016. What is Pre-Tax Operating Income.

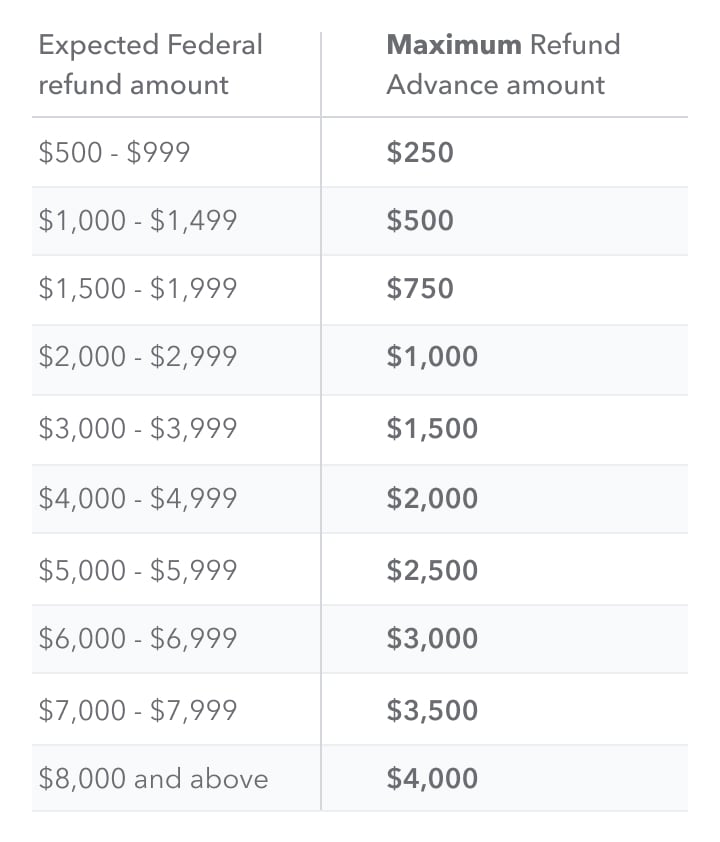

The formula for pre-tax operating income is. Most tax refund loans are available within 24 hours. These loans are typically based on the full amount of the tax refund youre expecting but loans can be made for a partial amount of your anticipated refund.

They are popular for people who claim the EITC and need a little help making ends meet early in the year. The IRS allows loans of 50000 or 50 of your vested balance whichever is less. 1 500 Bonu also referred to as Free Tax Loan is an optional tax refund related loan not your tax refund and is via ATC Advance for qualified individuals Not EML.

ETax Loan is an online service that provides access to safe and secure income tax anticipation loans to consumers. Pre-tax operating income is a companys operating income before taxes. Your information is always safe when you apply for eTax Loan Online Loans.

These secured loans are held against your tax refund. We live in society which demands immediate results.

Tax Refund Advance Get Up To 4 000 Turbotax Official

Tax Refund Advance Get Up To 4 000 Turbotax Official

Maximize Tax Savings On Inter Spousal Loans Before April 1 2018 Bridgeport Asset Management Inc

Maximize Tax Savings On Inter Spousal Loans Before April 1 2018 Bridgeport Asset Management Inc

Advance Tax Under Income Tax Act 1961

Advance Tax Under Income Tax Act 1961

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-150973259-56a066b75f9b58eba4b0452f.jpg) How Tax Refund Advances And Loans Work Pros And Cons

How Tax Refund Advances And Loans Work Pros And Cons

Do Home Loans Help You Save On Income Tax Read More

Trump S Taxes What You Need To Know Bbc News

Trump S Taxes What You Need To Know Bbc News

Pretax Income Definition Formula And Example Significance

Pretax Income Definition Formula And Example Significance

Tax Refund Loan Tax Anticipation Loan Incometaxadvances Com

Tax Refund Loan Tax Anticipation Loan Incometaxadvances Com

Ppp Loan Forgiveness Which States Are Taxing Forgiven Ppp Loans

Ppp Loan Forgiveness Which States Are Taxing Forgiven Ppp Loans

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Comments

Post a Comment