- Get link

- X

- Other Apps

Estimate the IRA growth rate by applying the Rule of 72. An individual retirement account is just that -- an account.

Ira Information Types Of Iras Traditional And Roth Wells Fargo

Ira Information Types Of Iras Traditional And Roth Wells Fargo

Historically those down years have always been offset by years of growth.

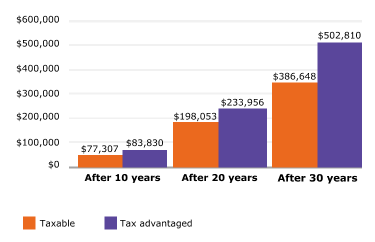

Ira growth rate. It is important to note that this is the maximum total contributed to all of your IRA accounts. Historically with a properly diversified portfolio. The taxable withdrawals are taxed at your normal income tax rate which could be as high as 37 percent compared to the maximum long-term capital gains tax rate.

Using the Rate Table. Equities to return between 39 and 59 before adjusting for inflation per year over the next 10 years due to high valuations and low interest rates. That said Roth IRA accounts have historically delivered between 7 and 10 average annual returns.

Enter a 1 if you think Social Security will exist else enter a 0 zero If your employer matches your contribution then enter that matching percentage here. From January 1970 to December 2009 the average annual compounded rate. IRA growth depends on its underlying investments how much money is invested and other factors.

When a 7 growth. Youve taken an important step on the road to a comfortable retirement. Your IRA is not an investment unto.

The annual rate of return for your IRA. Many IRA plans may state that the annual rate of return is 8 percent. GDP Annual Growth Rate in Iran averaged 396 percent from 1963 until 2020 reaching an all time high of 2301 percent in the second quarter of 1992 and a record low of.

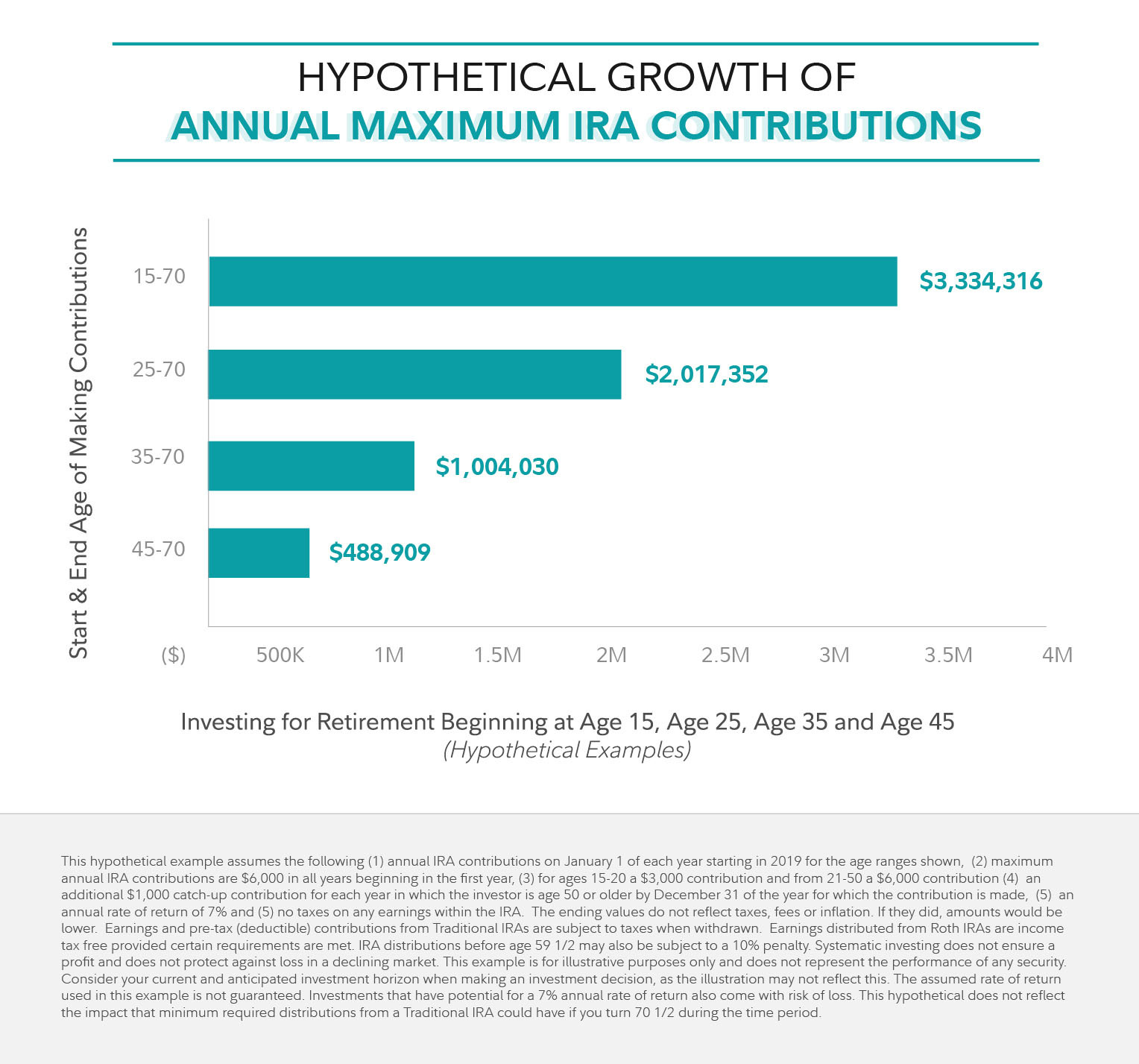

This means that employees can contribute 100 of their income into a SIMPLE IRA. For example from December 1999 to December 2009 the average annual compounded rate of return for the SP 500 was -06 including reinvestment of dividends. The maximum annual IRA contribution of 5500 is unchanged for 2015.

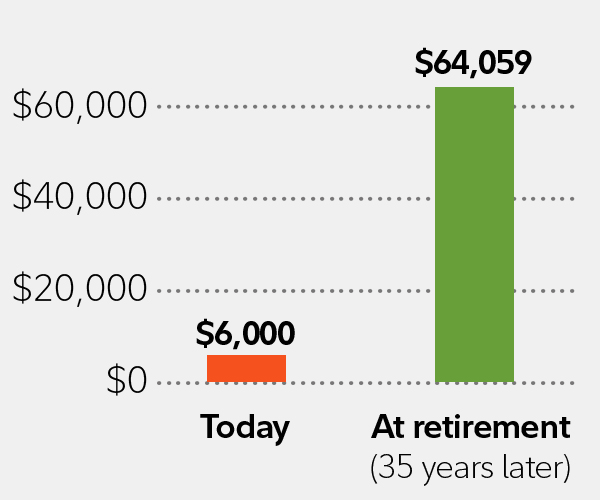

If the contribution limit remains 6000 per. When it comes to your retirement. There are several factors that will impact how your money grows in a Roth IRA including how diversified your portfolio is your timeline for retiring and your risk tolerance.

But for most people thats not enough. The actual rate of return is largely dependent on the type of investments you select. The investment firm Vanguard expects US.

The Secure Act signed into law on December 20 2019 removed the age limit in which an individual can contribute to an IRA. This calculator assumes that you make your contribution at the beginning of each year. IRA rates vary based on the underlying investments which in the case of an IRA CD is a certificate of deposit.

Contact the IRA provider if this number is not readily available or if the documentation is unclear. Divide the ending value of your IRA account by the amount you started with in your IRA. Youre saving in an IRA.

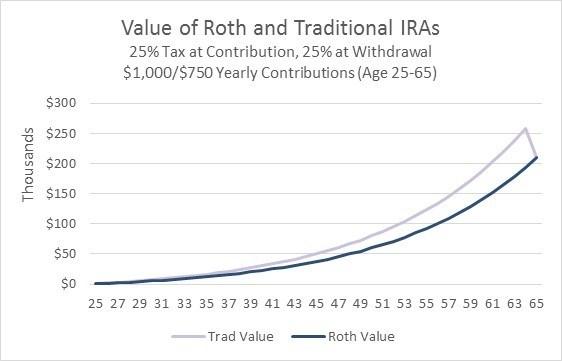

This is the number needed for the calculations. The Roth IRA calculator defaults to a 6 rate of return which should be adjusted to reflect the expected annual return of your investments. As of 2021 contributions into traditional and Roth IRAs are.

If you contribute 2000 to a traditional IRA and qualify for the full 2000 tax deduction the value of your tax deduction is 2000 X 30 or 600. Specifically the calculator will generate a year-by-year. Any investment you hold in your IRA will perform exactly the same way that same investment would.

This online IRA Growth and Distribution Calculator which has been updated to conform to the SECURE Act of 2019 will attempt to forecast the future growth of your IRA as well as the required minimum distributions RMDs that will begin once you reach age 70-12 or age 72 for SECURE Act. And starting in 2020 as long as you are still working there is no age limit to be able to contribute to a Traditional IRA. The after-tax cost of contributing to your.

This calculator assumes that your return is compounded annually and your contributions are made at the beginning of each year. You can select from any number of investment vehicles such as cash bonds stocks ETFs mutual funds real estate or even a small business. IRA Growth Rate Retirement Account.

The next step is investing your savings for long-term growth. Enter the expected generosity of the pension plan L for Low M for Medium H for High Enter the percentage increase in salary you expect over the long term. Lets say you open a Roth IRA and contribute the maximum amount each year.

The 1-Year IRA CD also called a 12 Month IRA is offered with the highest interest rates by credit unions followed by online banks. For example if you invested 4000 and over three years it grew to 4950 divide 4950 by 4000 to get 12375. The contribution limit increases with inflation in.

Calculate the Yth root of the result where Y equals the number of years it took to generate the returns in your IRA. In our rate table above you can view membership requirements for the corresponding credit union by clicking the plus button to the left of. In 2013 the index grew by nearly 30 and 2019 is tracking for 26 growth.

In both cases annual contribution limits are 13500 additional 3000 for employees over 50 or 100 of compensation. The second is a fixed rate of 2 of every employees compensation regardless whether they participate.

Systematic Partial Roth Conversions Recharacterizations

Systematic Partial Roth Conversions Recharacterizations

Ira Kids Compound Interst Growth Of Roth Iras A Kid S Key To Future Wealth

Fidelity Investments Continues To Strengthen Ira Leadership In 2019 Millennials Lead Charge With 43 Of Roth Iras Receiving Contributions Business Wire

Fidelity Investments Continues To Strengthen Ira Leadership In 2019 Millennials Lead Charge With 43 Of Roth Iras Receiving Contributions Business Wire

Roth Vs Traditional Iras Seeking Alpha

Roth Vs Traditional Iras Seeking Alpha

Why You Should Save Money In A Roth Ira When You Re Young

Contributing To Your Ira Fidelity

Contributing To Your Ira Fidelity

What S Best Traditional Ira Vs Roth Ira Familywealth

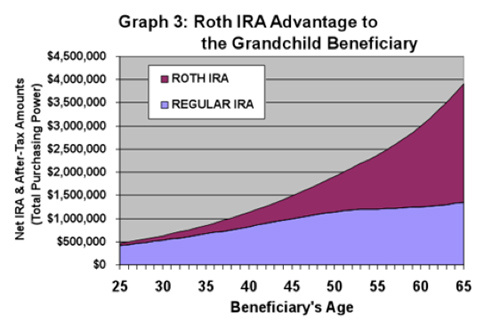

Spoil Your Grandkids With A Roth Ira Weiss Ratings

Spoil Your Grandkids With A Roth Ira Weiss Ratings

A Fully Funded Roth Ira At Age 18 Could Net You 3 5 Million Dollars No Credit Needed

A Fully Funded Roth Ira At Age 18 Could Net You 3 5 Million Dollars No Credit Needed

When To Roth Considerations For Choosing Or Converting To A Roth Ira Glenmede

When To Roth Considerations For Choosing Or Converting To A Roth Ira Glenmede

Roth Four Little Letters Retirement Pittsburgh

Roth Four Little Letters Retirement Pittsburgh

How To Invest Your Ira Fidelity

How To Invest Your Ira Fidelity

Roth Iras How To Optimize Yours For 2021

Roth Iras How To Optimize Yours For 2021

Comments

Post a Comment