- Get link

- X

- Other Apps

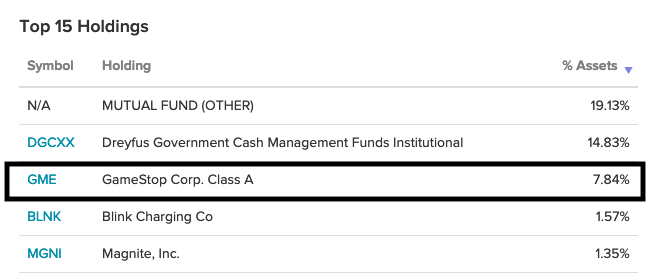

Three ETFs benefited significantly from last weeks GameStop short squeeze but their fortunes could changes just as quickly with the volatile stock now a major position in each fund. Other ETFs with GameStop exposure include Direxion Daily Retail Bull 3x Shares RETL -262 Invesco SP SmallCap Value with Momentum ETF XSVM -139 Invesco SP SmallCap 600 Revenue ETF RWJ.

Leveraged Etfs Were Already Bold Moves This One Plays Gamestop

Leveraged Etfs Were Already Bold Moves This One Plays Gamestop

This led to a spike in trading and an outflow of.

Etf with gamestop. 12630000000 of Market Cap. And the largest ETF in the category the 219 billion-in-assets Vanguard Small-Cap Value ETF VBR only holds 031 of its assets in GameStop. GameStop accounts for just 002 of the Vanguard Total Stock Market ETF VTI but was responsible for 04 of the funds return a.

Both ETFs were down 8 or more at midday. 67 Zeilen Top 66 ETFs with GME GameStop Corp. GameStops surge in price and market cap is having a significant impact on some of the ETFs that hold it.

Consider the Wedbush ETFMG Video Game Tech ETF GAMR the fund that has the enviable or problematic depending how you look at it position of. 26 Zeilen ETFs with GameStop Corp. The Retail ETFs holdings were suddenly highly in demand due to GameStops momentum according to Bloomberg Intelligence.

How the Cambria Shareholder Yield ETF SYLD ended up being the ETF with the largest allocation to Gamestop GME at the start of. SPDR SP Retail ETF. The 189 million Wedbush ETFMG Video Game Tech ETF GAMR has soared 38 year to datea 21 jump on Wednesday alone by mid-morning trading.

GameStock is now its top holding occupying 193 of its assets. This ETF offers exposure to the companies involved in the video game technology industry game developers console and chip manufacturers and game retailers. The other ETF GAMR the Wedbush ETFMG Video Game Tech is market cap weighted and GameStop accounted for over 27 of its assets at noon on Thursday.

GameStop has soared during January but is under owned by ETFs given its more than 20 billion market capitalization. The 176bn SPDR SP Retail ETF XRT is up a handsome 365 for the year including a 172 surge last week. For example collectively Tesla.

Major holders that have opened. As more young investors take up day trading I have a recipe for long-term wealth creation. Total Market Value Held by ETFs.

Among the most affected is the Wedbush ETFMG Video. Class A GME Exposure The following ETFs maintain. GameStop has put some ETFs out of balance but even ETFs that are weighted by market cap have similar risks.

Just 63 funds own a position in the company. Number of ETFs Holding GME. More than 70 of that gain came from GameStop stocks.

Among the more intriguing ones.

Gamestop Drama Hammers Retail Etf As Nearly 80 Of Assets Exit Bloomberg

Gamestop Drama Hammers Retail Etf As Nearly 80 Of Assets Exit Bloomberg

Leveraged Etfs Were Already Bold Moves This One Plays Gamestop

Leveraged Etfs Were Already Bold Moves This One Plays Gamestop

Is Gamestop In Your Etf Wealth Management

Is Gamestop In Your Etf Wealth Management

Retail Etf With Highest Short Interest Was Blown Up By Gamestop Quartz

Retail Etf With Highest Short Interest Was Blown Up By Gamestop Quartz

Investors Dump State Street Etf After Gamestop Weighting Surges Financial Times

Investors Dump State Street Etf After Gamestop Weighting Surges Financial Times

With Gamestop Running Wild These Etfs Are Seeing The Highest Volume

With Gamestop Running Wild These Etfs Are Seeing The Highest Volume

Gamestop Drama Hammers Retail Etf As Nearly 80 Of Assets Exit Bloomberg

Gamestop Drama Hammers Retail Etf As Nearly 80 Of Assets Exit Bloomberg

Gme The Gamestop S Frenzy Reaches Etfs Trackinsight

Gme The Gamestop S Frenzy Reaches Etfs Trackinsight

Gamestop Gme Boosts Etf Volatility Seeking Alpha

Gamestop Gme Boosts Etf Volatility Seeking Alpha

Comments

Post a Comment