- Get link

- X

- Other Apps

Consolidated Audit Trail CAT Summary The Securities and Exchange Commission SEC is creating a Consolidated Audit Trail CAT that would enable regulators to track all activity throughout the US. We deploy deep expertise leading technology and extensive market intelligence to serve as the first line of oversight for the brokerage industry - all at no cost to taxpayers.

Consolidated Audit Trail Go Live Is Now A Certainty Kx

Consolidated Audit Trail Go Live Is Now A Certainty Kx

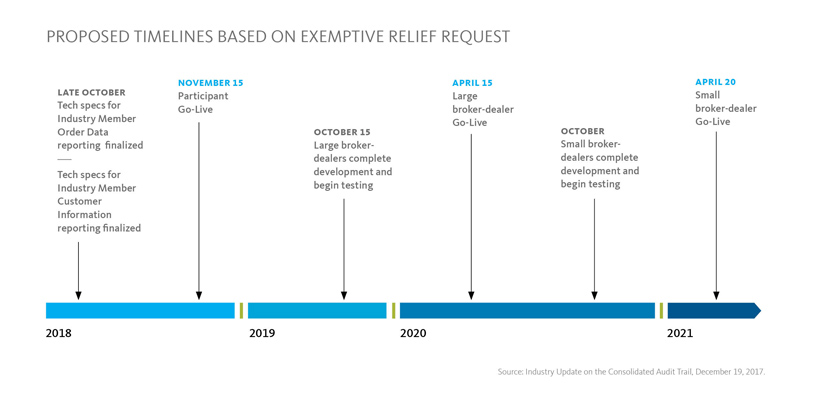

With the approval of the Securities and Exchange Commission SEC Rule 613 consolidated audit trail CAT National Market System NMS plan industry timelines for the implementation of the CAT are in effect.

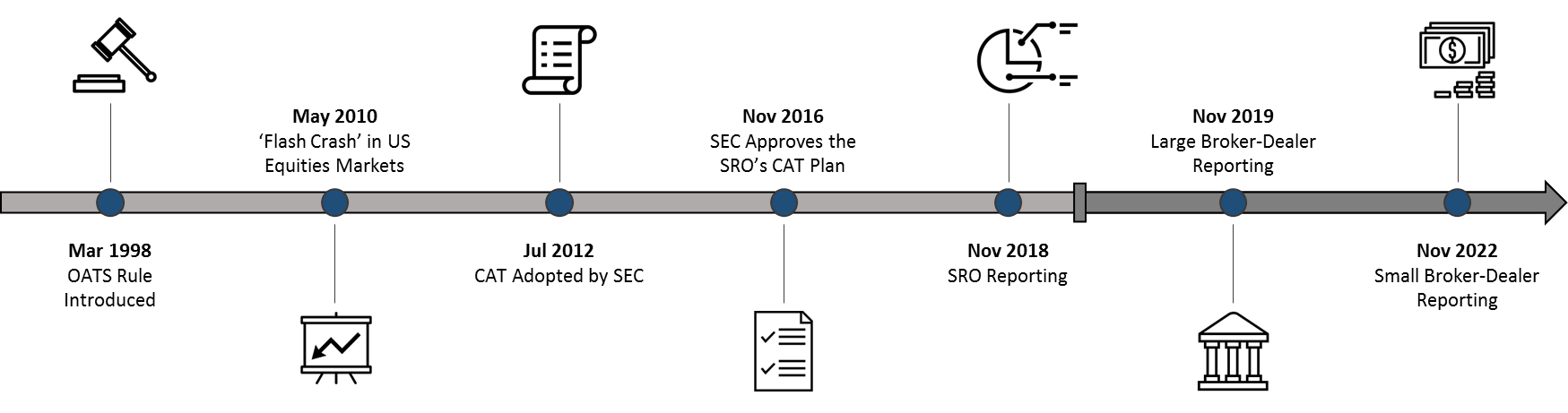

Consolidated audit trail. FOR IMMEDIATE RELEASE 2020-189 Washington DC Aug. The Consolidated Audit Trail CAT is one the most comprehensive regulatory obligations that firms participating in the US. The United States US Securities and Exchange Commission SEC adopted Rule 613 Rule 613SEC in 2012 to create Consolidated Audit Trail CAT the intended to allow regulators to monitor activity in National Market System NMS securities throughout the U markets.

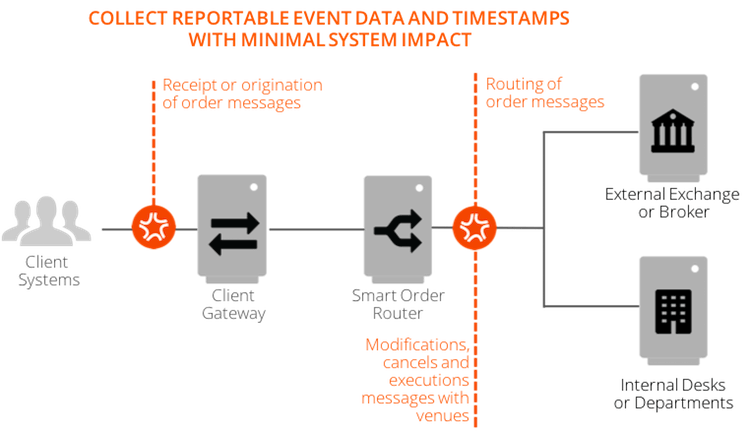

The Consolidated Audit Trail CAT is a massive government-mandated database that will track every equities and options market event in the US financial industry over a six-year period. 21 2020 The Securities and Exchange Commission today proposed amendments to the national market system plan governing the Consolidated Audit Trail the CAT NMS Plan to bolster the Consolidated Audit Trails. Our equities and options markets operate through multiple exchanges and other venues and the CAT will facilitate cross-market oversight and analysis thereby improving investor protection and market integrity.

About CAT On July 11 2012 the US. April 13 2020 multiple releases June 22 2020 Phase 2a July 20 2020 Phase 2b. 9 If an Industry Member has more than one IMID the following criteria should be used to determine how to populate the senderIMID receiverIMID and destination fields.

Equities and options markets have had to implement. For listed-equities and options. Securities and Exchange Commission SEC voted to adopt Rule 613 under Regulation NMS requiring the national securities exchanges and national securities associations listed here collectively the SROs to submit an NMS plan Plan to the SEC to create implement and maintain a consolidated audit trail CAT.

Consolidated Audit Trail CAT SIFMA has long supported the efforts of the Securities and Exchange Commission SEC to create a comprehensive Consolidated Audit Trail that would enable regulators to efficiently and accurately track all activity throughout the US. The Consolidated Audit Trail CAT is a regulatory reporting utility commissioned by the Securities and Exchange Commission SEC to enable regulators to more fully track trading activity and boost transparency. Key Concepts There are two separate and distinct concepts.

The consolidated audit trail CAT is intended to enhance regulatory oversight of our securities markets. SEC Rule 613 requires FINRA and the national securities exchanges to jointly submit a National Market System NMS plan detailing how they would develop implement and maintain a consolidated audit trail that collects and accurately identifies every order cancellation modification and trade execution for all exchange-listed equities and options across all US. And now is the time for.

An audit trail also called audit log is a security-relevant chronological record set of records andor destination and source of records that provide documentary evidence of the sequence of activities that have affected at any time a specific operation procedure event or device. 2Trading Accounts addressed in the NMS Plan and represented by the Firm Designated ID FDID. This can represent firm or customer accounts.

Audit records typically result from activities such as financial transactions scientific research and health. Consolidated Audit Trail LLC has entered into an agreement with FINRA CAT LLC obligating FINRA CAT LLC as the Plan Processor to perform the functions and duties contemplated by the Plan including the management and operation of the CAT. For orders received from or routed to an alternative trading system ATS the FINRA ATS MPID must be used.

1Customersdefined in Rule 613 and represented by the CAT Customer ID CCID. The CAT also heralds significant new obligations and reporting requirements for firms. We are a not.

February 12 2019 Financial services 2019 has started out to be very active for the Self-Regulatory Organizations SROs and the Consolidated Audit Trail CAT program. For listed-equities and options. FINRA enables investors and firms to participate in the market with confidence by safeguarding its integrity.

Consolidated Audit Trail Cat January 2020 Update Oyster Consulting

Sec Rule 613 Consolidated Audit Trail Compliance Deloitte Us

Sec Rule 613 Consolidated Audit Trail Compliance Deloitte Us

Consolidated Audit Trail Go Live Will Happen Patience Required Kx

Consolidated Audit Trail Go Live Will Happen Patience Required Kx

Monticello Consulting Group Consolidated Audit Trail A Reaction To The 2010 Flash Crash

Monticello Consulting Group Consolidated Audit Trail A Reaction To The 2010 Flash Crash

Consolidated Audit Trail Cat Pico

Consolidated Audit Trail Cat Pico

Https Www Catnmsplan Com Wp Content Uploads 2019 03 Cat Industry Call 03192019 Presentation Pdf

Firm S Guide To The Consolidated Audit Trail Firm S Guide To The Consolidated Audit Trail Sifma

Firm S Guide To The Consolidated Audit Trail Firm S Guide To The Consolidated Audit Trail Sifma

Consolidated Audit Trail Challenges Solutions Refinitiv Perspectives

Consolidated Audit Trail Challenges Solutions Refinitiv Perspectives

Consolidated Audit Trail Broadridge

Consolidated Audit Trail Broadridge

Consolidated Audit Trail Broadridge

Consolidated Audit Trail Broadridge

Consolidated Audit Trail Text Medic

The Effects Of Consolidated Audit Trails On Broker Dealers

The Effects Of Consolidated Audit Trails On Broker Dealers

Consolidated Audit Trail Implementation Oyster Consulting

Consolidated Audit Trail Implementation Oyster Consulting

Consolidated Audit Trail Cat Will Your Firm Be Ready To Report Oyster Consulting

Comments

Post a Comment