- Get link

- X

- Other Apps

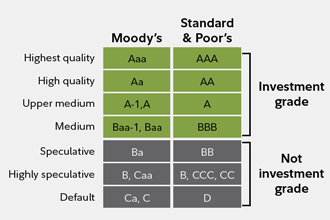

The Schwab-sponsored PIMCO Municipal Bond Ladder SMAs employ a professionally managed buy-and-hold strategy with a focus on investment selection and ongoing credit monitoring. When Schwab acts as principal the bond price includes our transaction fee and may also include a markup that reflects the bid-ask spread and is not subject to a minimum or maximum.

Https Www Schwab Com Public File P 11206897

For help building a bond ladder or finding the right strategy for you Call a Schwab Bond Specialist at 800-626-4600.

Schwab bond ladder. Wasmer Schroeder bond ladder strategies use a separately managed accounts portfolio structure to give you a more personalized and focused retirement income option. Get professional guidance on a more tailored income source. Bond Ladders Fixed Income Specialists Money Market Funds Annuities Overview.

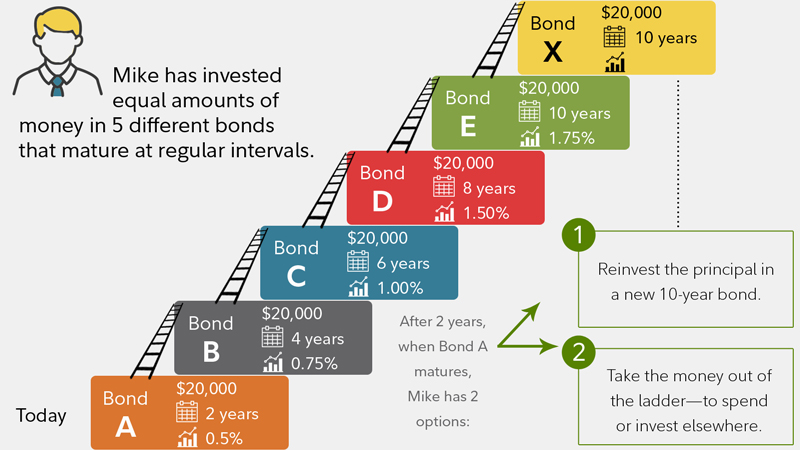

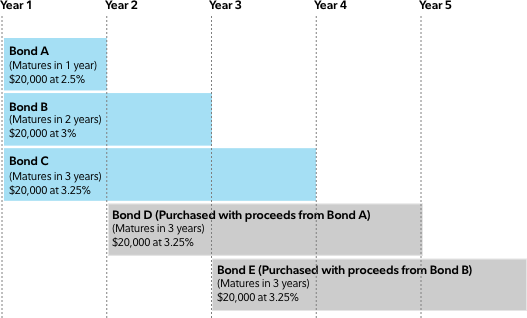

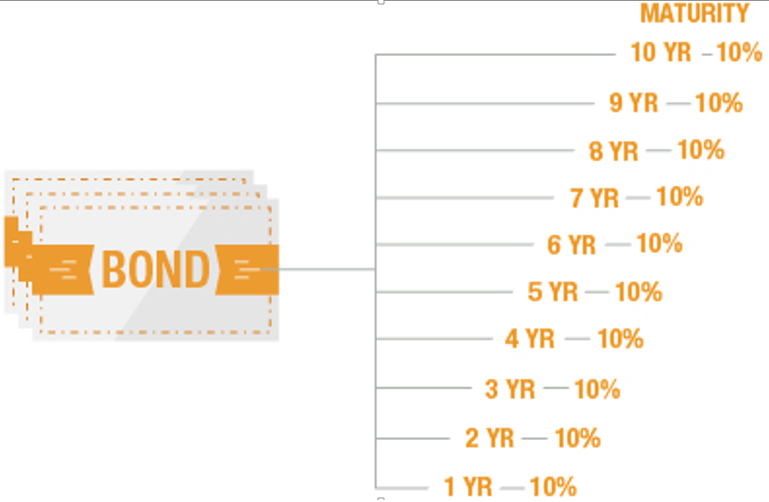

The individual bonds are the rungs and the time between maturities is the spacing between the rungs. Bond ETFs are subject to many of the same risks as most fixed income securities such as interest rate credit liquidity reinvestment inflation or purchasing power and market and event risks. For example you might be able to build a ten year bond ladder with a bond maturing every year.

Please refer to the Charles Schwab Investment Management Inc. All prices are subject to change without prior notice. Schwab ETFs and all ETFs trades are commission-free.

Bond ladders vs. Both CSIM and Schwab are separate entities and subsidiaries of The Charles Schwab Corporation. When trading as principal Schwab may also be holding the security in its own.

Access to Electronic Services may be limited or unavailable during periods of peak demand market volatility systems upgrade. 1 Schwab offers commission-free online trades in a Schwab account. CSIM Wasmer Schroeder Strategies Disclosure Brochure for additional information.

Realizing that advisors needed help with ladders Schwab decided to offer an automatic bond ladder investment composed entirely of PIMCO municipal bonds. Schwab reserves the right to act as principal on any fixed income transaction public offering or. Bond ladders can help take the guesswork out of investing A bond ladder is a portfolio of individual bonds that mature on different dates.

The fundamentals of using bond ladders for your retirement income1013-5385. Schwab likes bond ladders which are designed to create a predictable income stream by spreading out bond maturities over time. Alternatively you could use a bond laddera portfolio of individual bonds or certificates of deposit that mature at regular intervalswhich also allows you to reinvest the proceeds from maturing bonds in higher-yielding bonds once interest rates move up.

If interest rates move higher you can reinvest short-term bonds. Picture a ladder with several rungs and spacing between the rungs. Bond Ladders Fixed Income Specialists Money Market Funds Annuities Overview.

Picture a ladder with several rungs and spacing between the rungs. Bond ladders can help take the guesswork out of investing A bond ladder is a portfolio of individual bonds that mature on different dates. Schwab Asset Management is a part of the broader Schwab Asset Management Solutions organization SAMS a collection of business units of The Charles Schwab Corporation aligned by a common functionasset management-related servicesunder common leadership.

Bond Laddering - Bond Strategy Charles Schwab. Can you get the predictable income of bonds and the flexibility to reinvest if rates go up. Bonds available through Schwab may be available through other dealers at superior or inferior prices compared to those available at Schwab.

Bond ladders can help reduce portfolio risk and provide a steady income. Learn how they work how they are built and see how Schwabs new tool can help. For help building a bond ladder or finding the right strategy for you Call a Schwab Bond Specialist at 800-626-4600.

The individual bonds are the rungs and the time between maturities is. With a bond ladder the answer is yes. A bond ladder is a portfolio of individual bonds that mature on different dates.

With a bond ladder the answer is yes. Its banking subsidiary Charles Schwab Bank member FDIC and an Equal Housing Lender provides deposit and lending services and products. CSIM is a registered investment adviser and an affiliate of Charles Schwab Co Inc.

As the bonds at the lower end of the ladder mature the proceeds can be reinvested at the long end in new long-term bonds. Wasmer Schroeder bond ladder strategies.

Do Bonds Still Provide Diversification Charles Schwab

Do Bonds Still Provide Diversification Charles Schwab

Why Bonds Still Matter Charles Schwab

Why Bonds Still Matter Charles Schwab

How To Build A Bond Ladder Fidelity

How To Build A Bond Ladder Fidelity

Http Www Schwab Com Public File P 3759122 Oin 0810 August Midlife Finra Pdf

Bond Ladder Tool From Fidelity

Bond Ladder Tool From Fidelity

Easy Steps For Building A Bond Ladder Seeking Alpha

Easy Steps For Building A Bond Ladder Seeking Alpha

How To Build A Bond Ladder Fidelity

How To Build A Bond Ladder Fidelity

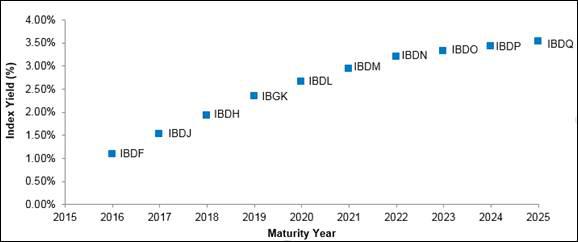

Diversify Now Building New And Improved Bond Ladders Ticker Tape

Diversify Now Building New And Improved Bond Ladders Ticker Tape

Why Own Bonds When Yields Are So Low Charles Schwab

Why Own Bonds When Yields Are So Low Charles Schwab

Https Www Schwab Com Public File P 11206897

Individual Bonds Vs Bond Funds

Individual Bonds Vs Bond Funds

Managing Interest Rate Risk With Bond Ladders Invesco Commentaries Advisor Perspectives

Managing Interest Rate Risk With Bond Ladders Invesco Commentaries Advisor Perspectives

Why Bonds Still Matter Charles Schwab

Why Bonds Still Matter Charles Schwab

Do You Know How Much You Re Paying For Bonds Charles Schwab

Do You Know How Much You Re Paying For Bonds Charles Schwab

Comments

Post a Comment